A Solution for Small Breweries to Generate Extra Income Using Existing Equipment

Operating a small business means you’re flexible, isn’t it?

You can pivot fast without corporate red tape.

However, sales can fluctuate – seasons change, tastes evolve, and suddenly your main product isn’t selling as quickly.

Here’s where extra earnings for small breweries using existing equipment comes in.

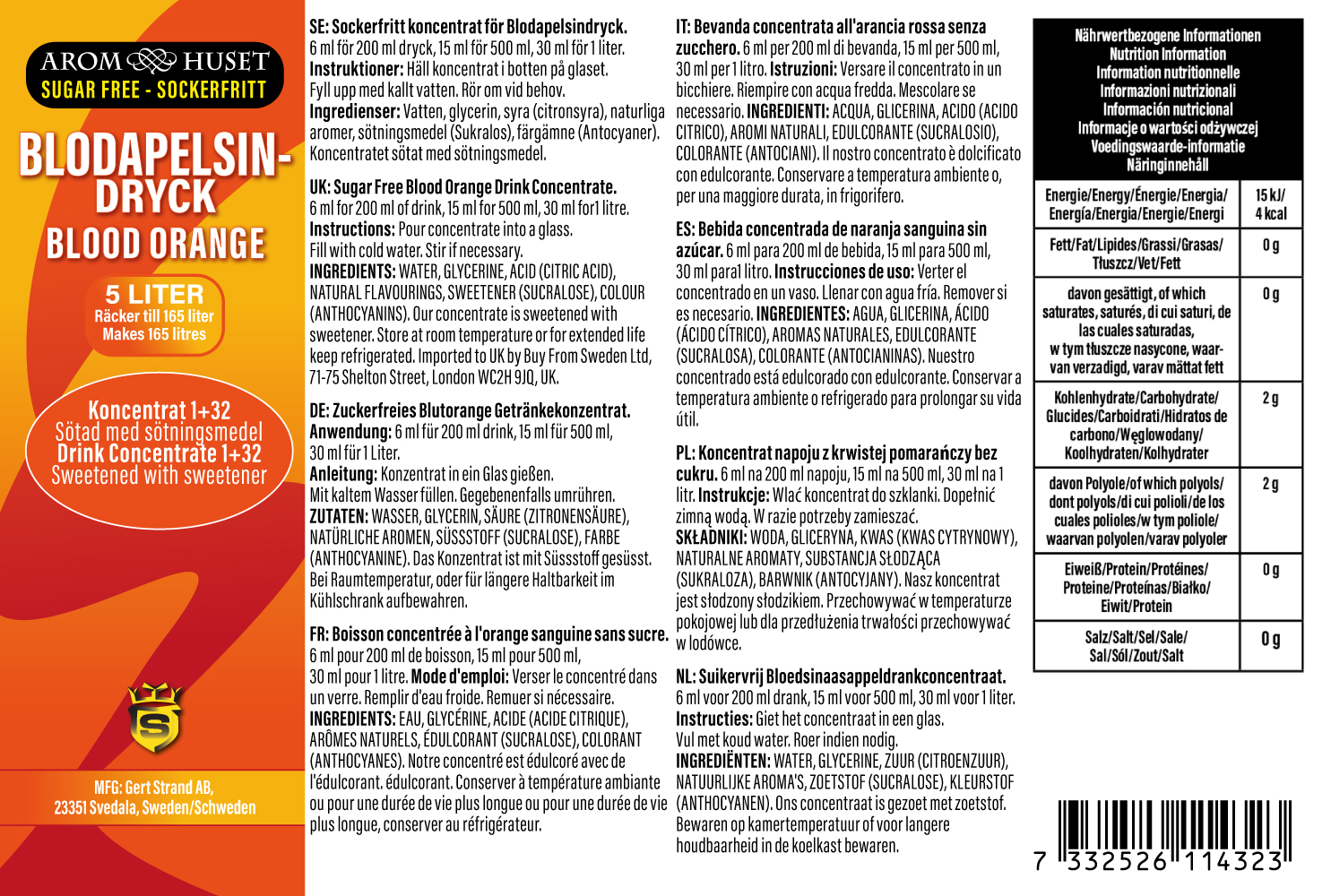

Using Aromhuset’s concentrates, you can make still beverages (imagine flat, refreshing sodas without fizz) that are sugar-free, exceptionally tasty, and exclusive.

No one else on the market offers this in concentrate form – until now.

Picture this: your micro brewery’s bottling line, usually humming with beer or cider, now churning out bottles of zesty grapefruit still drink or exotic fruit explosion

The health-conscious customers are enthusiastic about the zero-sugar aspect, as the beverage is sweetened with a natural-tasting sucralose derived from sugar, which is 600 times sweeter, making it virtually undetectable that it’s sugar-free

Having personally tested the drinks: a small quantity at the bottom of a glass, mixed with still water, and presto – incredibly refreshing, with no strange aftertaste

A satisfying and well-balanced soda is achieved with the delicate sweetness contrasting with the tangy notes

Specifically crafted for micro distilleries, breweries, and small bottlers, Aromhuset from Gert Strand AB in Sweden creates these products

Key perks that make this a no-brainer:…Sweetened with high-purity sucralose – made from sugar but insanely sweet, so tiny amounts do the trick. No acesulfame or aspartame, which can leave a bitter edge. Tastes clean and real.

Mix different flavors: Every kind mixes together smoothly. Craft your own special blends, such as a grapefruit-passionfruit combination or a banana-rhubarb fusion.

Some of the most popular types are Grapefruit, Pineapple, Rhubarb, Grapefruit-Passionfruit, Banana, Blood Orange, Fruit Explosion, Grapefruit-Blood Orange, Gooseberry, Lemon-Lime, Raspberry, Strawberry, and Passionfruit

The great thing is, you don’t need any new equipment

Let me give you a brief overview of the process

Obtain your concentrate: Buy it from Aromhuset. Start with a small quantity for experimentation – like a 500ml bottle of Grapefruit to sample.

Mix things up: In your tank, combine 1 part concentrate with 32 parts of filtered still water. Gently stir – finished within minutes. No need for heat, no trouble.

Expense? A 500ml concentrate could cost £3, producing 16.5L – roughly 50 x 330ml bottles

Health trends are massive – folks want sugar-free without sacrificing taste

Being ahead of the competition in concentrate form means you are the trailblazer

In the UK, non-alcoholic drinks sales jumped 20% last year, with zero-sugar leading

Areas of interest:

Overcoming Common Hurdles: What to Watch For

Let’s stay grounded – there are a few aspects worth considering:

Water quality matters – use filtered or spring for best taste

Dive deeper into flavours: Grapefruit is sharp, wake-up call

Pineapple gives a tropical escape

Rhubarb evokes tangy nostalgia

Blend Grapefruit-Passionfruit for a zingy adult sip

All mixable – create “Brewer’s Berry Blast” or any blend that suits your brand

Are you set to go?

Perform a 10L test batch on a calm day.

Mark with a label, sell locally, and gather feedback.

Expand, list on the internet, and pitch to pubs.

This is extra income for small breweries using existing equipment at its finest – low risk, high reward, fun flavours.

Your arrangement is prepared; Aromhuset supplies the secret formula.

Try it out and see your earnings bubble up (well, figuratively) increase.

Here’s to that!